TE offers leather insights in Material Change report

US-based non-profit the Textile Exchange has published its annual Material Change Insights Report, looking at the progress made by 424 companies that submitted data through its Materials Benchmark for 2021.

It provides insights on materials uptake, as well as alignment with climate and nature goals and the transition to a circular economy.

Forty-three companies completed the leather module and the Textile Exchange estimates the volumes (measured in weight of fresh hides) reported represented up to 3.7% of global leather production in 2021 (over 12.5 million tonnes).

Just over 70% of this leather was sourced from Leather Working Group (LWG)-certified tanneries.

The MCI Leather Index is currently at a Level 1 (Developing). This lower average (compared with other modules) reflects what TE describes as "the limited options for leather programmes (standards at Tier 4) and challenges in connecting back to origin as much as it does the early stages of company management and performance of their leather supply".

In 2021, 91% of participants started managing risks associated with leather sourcing, 86% have animal welfare and/or leather sourcing policies or strategies and 49% refer to the use of certification schemes. Most companies use LWG certification that starts at the tannery. Connecting back to the farm level is complex, but there is genuine interest by companies and innovative work under way to enable the connection to be made, it said.

Transparency by volume has increased from 15% to 46% between last year’s report and this year. The US, Australia, and Argentina, followed by the UK, Italy, France, and Brazil, were the countries most cited as sourcing locations for leather products, and likely to be a combination of processors and feedstock origins due to the challenges in tracing to farm.

Farm-level supplier mapping remains a challenge with only 14% reporting to have carried out this exercise. However, 65% of participants have mapped most of their leather supply back to the tannery.

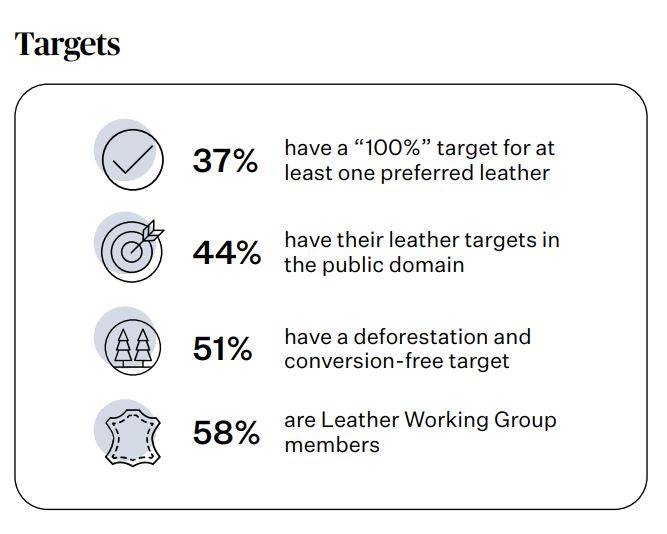

Over half have set deforestation and conversion-free targets. “Considering this share of participants was 19% last year, it is clear more companies are aware of the issue and want to be part of the solution,” said TE. “The next step will be to track progress and/or compliance with this target.” Other targets include sourcing only from LWG certified suppliers, or chrome-free leather.

Textile Exchange categorises “preferred leather” as organic, recycled, and Land to Market certified; the term ‘recycled leather’ should only be used if the fibre structure remains intact during the recycling process.

“We have allowed volumes of leather passing through LWG suppliers as a ‘half-way base’ until other programmes at the farm level shape up and become viable options,” it said.

Currently, 10 companies have achieved 100% LWG status and a further 37 companies have over 50% of their leather supply sourced from LWG suppliers. Beyond LWG verification, supplier declarations are used by participants to confirm their leather sourcing is meeting company sourcing requirements or their code of conduct. A further 16% of participants use identity preserved (IP) systems, mostly Organic Content Standard for organic and Global Recycled Standard or Recycled Claim Standard for recycled. There has not been much evidence to suggest traceability through digital or blockchain-based systems is shifting from pilots and trials into more scalable systems, added TE, but these types of platforms will arrive and help create the missing link back to farm.

It concluded that it would increase its focus on leather in the future: “As a high-risk material and a priority for Textile Exchange as well as many brands, we will see more activity in the leather space.”