Fundamental questions about a new price trend in the leather pipeline remain open

01/04/2014

It remains to be seen if answers will emerge during the show. We at least would not bet on it as the fairs have lost quite a bit of their ‘marketplace’ function over the years. We will certainly get opinions and views, we might even learn a bit about leather demand, but the fundamental questions about a new price trend in the market will certainly remain open. Why? Well, because the supply side is showing no indication of changing, at least in the short term, their story of strong demand and shortages.

The recent bonanza in the Brazilian market with prices rising since January by 15%-20 % was another strong indication of the need for the industry to buy. However, one could also see it from another point of view; perhaps other origins will miss sales in the second quarter because what they could have supplied has now been covered by South America because it was a cheaper option. With the strong performance of the split market and the good value of premium Brazilian hide splits, the square-foot price for grain is still far more attractive than many other options.

Looking at what has happened in the past months it is fair to say, that the sharp rise in raw material prices in 2013 has had the impact we expected. The industry is looking for cheaper raw materials, as the price-trend for cheaper raw materials and splits shows.

This is where many disagree about the general market situation. The optimists believe that the expansion of global leather demand accounts for the increases in raw material prices, while the pessimists believe it is only a shift from one price segment to the other. It is most likely that the truth lies, as usual, somewhere in the middle. The strong demand for splits and economic hides from South and Central America, as well as moves into Pakistan and Bangladesh, are the consequence of the price-hikes seen in the US, Australia and Europe in 2013. The industry has looked for more attractive alternatives because the rise in leather demand is fixed to a price-level for the material that can no longer be met by buying medium- and higher-priced raw material.

Let us take the automotive industry as an example. The premium end is doing well and premium brands are experiencing growth, but if you look at the numbers of cars and the additional leather consumed in the course of this growth, it is far less exciting. The massive growth in production and vehicles produced is in the standard, middle and lower price-ranges, in which if leather is used at all it is less expensive leather that uses less costly raw material.

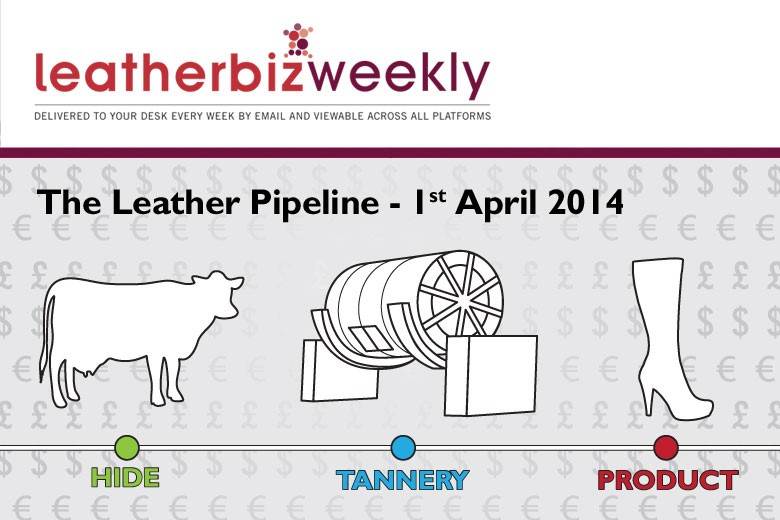

The situation has put the leather pipeline on a price carousel, which has been spinning faster recently making it more difficult and dangerous to jump off because the consequences will be painful. Even tanners who are desperately complaining about raw material costs know that a decline will reduce their raw material cost, but might have an immediate effect on leather prices too.

No matter how positive a picture some people paint, the old dogs in the trade see the risks rising and display plenty of concern behind closed doors. Nobody wants to add to the problems or trigger change.

Some warning signs cannot be ignored, however. The number of financial concerns is rising. More tanners are facing financial problems. Since last summer, more tanners have gone out of business or gone into administration than possibly in two years before that. The tightening of controls in China related to customs, pollution, and consumer safety has put quite a bit of sand into the engine. The number of shipments getting stuck in Hong Kong warehouses on their way to China is increasing. The local authorities are still pretending that this is only temporary, but it also means that money is tied up and risk potentials are growing.

So, for most, there might still appear to be nothing wrong with the leather business and the supply chain and product flow, but the problems of the minority can become a problem for the majority quickly too in this business, as those who have been in it for a long time know.

In such a situation, it is good to put the people together at a trade show for a few days. It may not finally clarify everything, but there is no question that the opinion of a large proportion of everyone involved in the trade will give a much better feel. There is still a big difference between exchanging emails or talking on the phone and sitting face-to-face with people being and being able to see them when they talk.

Consequently we expect a lot from the show and we will report what happens in our next issue. Not that we envisage a big change at or right after the fair, but a clear sentiment as to how many people are sitting on each side of the boat will let us know much more about what we have to expect from the rest of this and the next quarter.

We are not concerned about the leather business is such. Most tanneries are busy and a number of leather producers of good reputation and successful product range have published good or at least satisfying results for 2013 and, from the talks during the most recent fairs, they have also had a decent start to 2014. However, they cover only a small part of the industry.

The concern of several people is that raw material prices have risen substantially faster than leather prices. Even with the improved split credit the number of tanners who have used up their cheaper raw material stocks and now have to calculate replenishment costs, with increasing danger of profits turning into losses. At the same time, far more financing is needed and the combination between negative margins and higher financial needs can quickly become lethal in a business. This is already evident in the bankruptcies and payment delays that are being reported in many places. The problems of tanning and the rising costs in China are adding to the problem.

We relate the recent market rise to the increased split credit rather than a stronger leather business and better leather prices. Even the industrial shoe upper tanners and automotive tanners need to replenish their inventory; tanners in Taiwan and Korea as well as the tanners in Hebei province have reduced their purchasing and soaking by quite a bit. If we read the market in Europe and the US right, they are still dominated by the power of slaughterhouses and competition between processors. An increasing number of hides from these origins have slowly been substituted and, considering that we are entering the low season for leather production as we move into spring and summer, it is not a good combination. It seems to be time for a another shake-out in the industry if only for the sake of environmental issues in various countries.

The split market is still in a two-direction move. For the majority, leather-related splits are still jumping from record to record in terms of pricing, while splits or trimmings for the gelatine industry are falling in price. The direction of wet blue prices will be one of the questions answered in Hong Kong. Current prices can hardly be justified in view of cheaper grain material. However, if tanners are still short of cheaper alternatives, anything can happen.

The skin market is becoming a serious worry because the decline has now reached some of the so-called better grades. Spanish and Italian premium skins are now on their way down and the regular skins for nappa production can hardly find a buyer these days. There is plenty of offer of stocks around and prices are all over the place, but all of them very cheap. The market has been badly hit by the crisis in the Ukraine and the consequences for the trade with Russia. A warm winter, fashion trends and tannery shut-downs in Hebei province, where a large part of the skins have been fellmongered, have also played a part. A decent stock of raw material is now awaiting the warmer temperatures of spring and summer. This is not really a good cocktail, although several bargain hunters are already watching with interest. However, the main problem is not buying them, but where and how to store them until they can be used. This is the old problem in the skin business. The very top end of the nappa-quality range is still not being influenced by the situation.

What happens in the coming weeks will depend on the results of the Hong Kong fair. Large beef producers will continue to defend their market prices and pretend that there is no need to stimulate demand by lowering them. We can’t see much business being done except deals for odd bits and pieces, which always take place. We continue to watch the money side, which we think will prove decisive eventually.